#Spinning

Rieter demonstrates resilience in the challenging first half of 2025

As already announced in March 2025, the first half of 2025 presented a challenge in terms of revenue volume, but still largely met expectations due to the low order backlog. Revenue amounted to CHF 336.2 million, down 20% on the previous year’s period (first half of 2024: CHF 421.0 million).

The Machines & Systems Division posted an order intake of CHF 166.9 million (first half of 2024: CHF 211.5 million). Although Machines & Systems recorded an increase in demand, the closing of orders was significantly impaired by uncertainty surrounding customs tariffs and the geopolitical and economic situation.

The Components Division generated an order intake of CHF 95.7 million (first half of 2024: CHF 117.6 million) and is suffering under lower demand for components for new machines, primarily as a result of the cautious investment activity in the market.

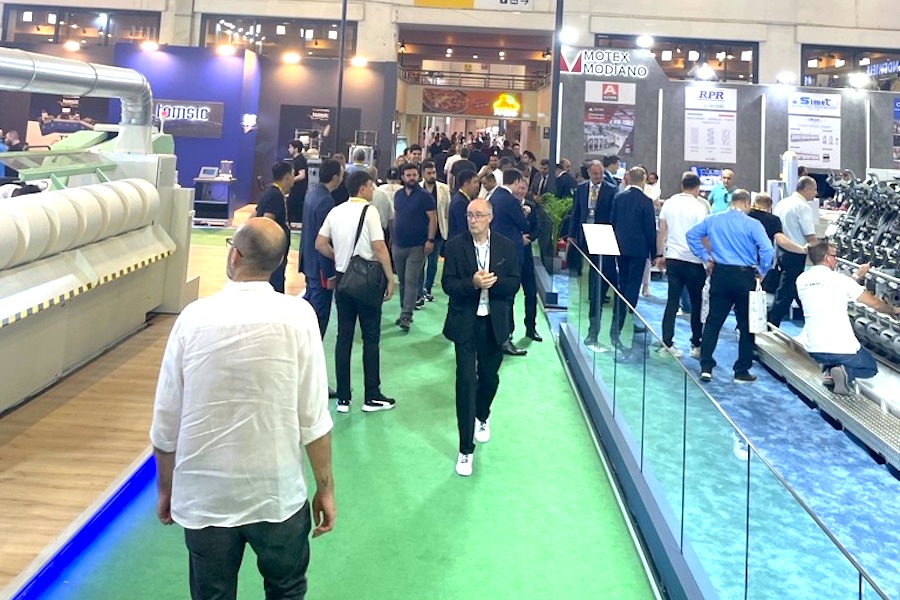

The After Sales Division recorded a gratifying 25% increase in its order intake to CHF 92.8 million (first half of 2024: CHF 74.3 million). This positive development confirms the strategic growth initiatives that have been initiated. Incoming orders are benefiting from increased sales activities in the target markets, such as Central Asia and China, as well as from the ongoing expansion of the service and repair network.

Sales

The Machines & Systems Division posted sales of CHF 144.0 million (first half of 2024: CHF 198.7 million), which corresponds to a decline of around 28%. At the same time, uncertainties surrounding market developments led to project delays for individual customers, which had a negative impact on the order intake and sales.

In the Components Division, revenue fell by 10% year on year to CHF 113.9 million (first half of 2024: CHF 126.5 million). Sales in the business units focusing on new machines remained below the previous year’s period, while the business areas focusing on consumables or man-made fibers were more stable.

The After Sales Division posted sales of CHF 78.3 million (first half of 2024: CHF 95.8 million). While business involving upgrades and repairs (Engineered Solutions) developed in a positive manner, the weaker sales performance of Machines & Systems led to lower revenue generated through the installation of new systems.

Order backlog

As at June 30, 2025, the company had an order backlog of around CHF 510 million (first half of 2024: CHF 640 million).

Non-recurring items, EBIT, net profit, free cash flow

The reporting period was affected by non-recurring effects from the planned acquisition of Barmag and restructuring costs in the amount of CHF 14.6 million.

Despite the decline in sales, Rieter achieved an operating result (before restructuring and transaction costs) of CHF -2.7 million.

Due to existing capacities and the fixed cost structure, revenue in the first half of 2025 was below the operational break-even point. Rieter continues to assume that sales will be significantly higher than the current level in a normalized market environment.

Rieter was again able to save a substantial amount of overhead costs. These amounted to around CHF 104.9 million in the first half of 2025 (first half of 2024: CHF 119.8 million). The figures demonstrate that the defined cost-saving measures were consistently implemented.

In the first half of 2025, the aforementioned effects resulted in a loss of CHF 17.3 million at EBIT level (first half of 2024: CHF 10.0 million).

Rieter closed the first half of 2025 with a net loss of CHF 20.0 million (first half of 2024: CHF 1.7 million). This decline is attributable to the lower sales volume achieved in the first half of 2025.

The free cash flow in the first half of 2025 amounted to CHF -36.7 million (first half of 2024: CHF -1.1 million). This was attributable to the losses at net profit level and the increase in inventories of finished goods that have not yet been retrieved by customers due to the overall macroeconomic situation.

Extraordinary General Meeting of Rieter Holding Ltd.

result in any outflow of funds. Subject to regulatory approval, the acquisition of the Barmag Division is expected to be completed by the end of the 2025 financial year.

The invitation to the Extraordinary General Meeting, including the agenda and the Board of Directors’ proposals, is expected to be sent to the shareholders on Monday, August 25, 2025, and will be published in the Swiss Official Gazette of Commerce as well as on the Rieter website.

Outlook for the full year 2025 adjusted

The Rieter Group expects a stronger second half of the year for the 2025 fiscal year, though this depends on a continued market recovery. As the market recovery has slowed due to macroeconomic uncertainties, Rieter is adjusting its sales forecast for 2025 as a whole. The company (without consideration of the Barmag Division) now expects sales of around CHF 750 to 800 million (previously: at the prior year’s level of around CHF 860 million).

Excluding restructuring costs and costs associated with the acquisition of Barmag, Rieter expects an operating EBIT margin at the lower end of the range of 0% to 4% for 2025 as a whole.

On Thursday, September 18, 2025, an Extraordinary General Meeting of Rieter Holding Ltd. is taking place to vote on the planned capital increases as part of the rights issue and the private placement to finance the acquisition of the Barmag Division, as well as on the reintroduction of the capital band that lapses by law as a result of the planned capital increases. Rieter’s largest shareholders, Peter Spuhler (around 33% shareholding) and Martin Haefner (around 10% shareholding) continue to support the planned capital increases and committed to participating in the rights issue pro-rata by exercising their subscription rights as well as investing additional capital through private placement. In addition, a capital reduction by means of a nominal value reduction is to be voted on, whereby the relevant reduction amount is to be allocated to the legal reserves from capital contributions and will therefore not result in any outflow of funds. Subject to regulatory approval, the acquisition of the Barmag Division is expected to be completed by the end of the 2025 financial year.

The invitation to the Extraordinary General Meeting, including the agenda and the Board of Directors’ proposals, is expected to be sent to the shareholders on Monday, August 25, 2025, and will be published in the Swiss Official Gazette of Commerce as well as on the Rieter website.

Outlook for the full year 2025 adjusted

The Rieter Group expects a stronger second half of the year for the 2025 fiscal year, though this depends on a continued market recovery. As the market recovery has slowed due to macroeconomic uncertainties, Rieter is adjusting its sales forecast for 2025 as a whole. The company (without consideration of the Barmag Division) now expects sales of around CHF 750 to 800 million (previously: at the prior year’s level of around CHF 860 million).

Excluding restructuring costs and costs associated with the acquisition of Barmag, Rieter expects an operating EBIT margin at the lower end of the range of 0% to 4% for 2025 as a whole.